PPC LANDING PAGES: BEST PRACTICES

FOR THE FINANCIAL SERVICES INDUSTRY

Experience Higher Conversions With Your PPC Campaigns

When running pay-per-click (PPC) campaigns, your landing pages play a crucial role in converting ad clicks into valuable leads. For financial services firms, landing pages aren't just another page on your website—they're often your first real chance to make an impression on potential clients.

After years of helping hedge funds, asset managers, and fintech firms build successful PPC strategies, we've picked up valuable insights into creating landing pages that genuinely resonate with your audience.

Below you'll find our practical, in-depth guide to crafting PPC landing pages that drive conversions and attract high-value clients.

What Exactly Are PPC Landing Pages?

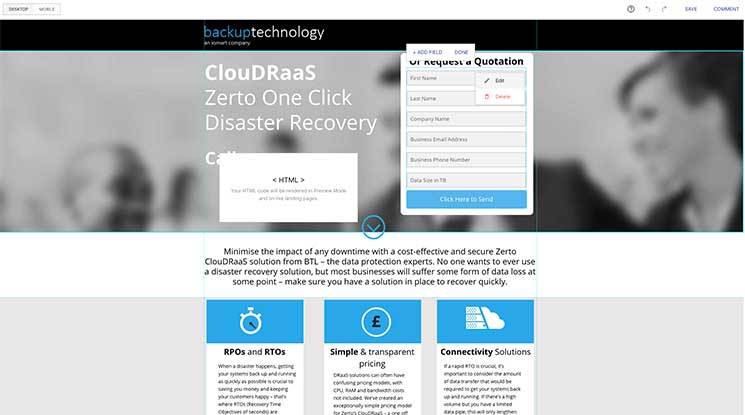

In simple terms, PPC landing pages are special, standalone webpages created exclusively for visitors who arrive via paid ads. These pages are carefully focused on a single, clear objective—such as signing up for a webinar, scheduling a consultation, or downloading a financial report—without distractions. The ultimate goal is straightforward: turning visitors into leads by clearly meeting their expectations.

Unlike regular website pages with multiple navigation options and purposes, PPC landing pages are laser-focused on conversion. They remove unnecessary distractions and guide visitors toward taking a specific action, making them an essential tool in your digital marketing arsenal.

The Psychology Behind Effective Landing Pages

Understanding the mindset of high-net-worth individuals and institutional investors visiting your landing page is crucial. These sophisticated investors are typically analytical, risk-aware, and security conscious. Your landing page must immediately establish credibility, demonstrate expertise, and project stability.

Institutional investors and high-net-worth clients also respond to evidence-based content, clear performance metrics, and professional presentation.

They need to see that you understand their specific investment goals and can provide solutions that align with their wealth preservation and growth objectives. Addressing these psychological factors in your landing page will create an immediate connection that drives conversions.

Essential Ingredients of High-Converting PPC Landing Pages

To make sure your landing pages consistently deliver results, include these key elements:

Keeping Ads and Landing Pages Aligned

Alignment matters—a lot. Consistency between your ad messaging and landing page content significantly improves trust and conversion rates. Visitors should always find what they expect when they click your ad.

This alignment extends beyond just headlines. The overall tone, visual style, and specific investment opportunities or services mentioned in your ads should be seamlessly reflected on your landing page. This consistency reassures sophisticated investors they're in the right place and builds trust in your brand's reliability.

Clear, Value-Focused Content

Your content must quickly explain the benefits to discerning investors. Skip the jargon—clearly show how your services address their needs or challenges directly.

High-net-worth individuals and institutional investors are looking for solutions to specific concerns—whether it's wealth preservation, tax-efficient growth strategies, or exclusive investment opportunities.

Structure your content to highlight these solutions, using concise paragraphs, bullet points, and subheadings that allow for quick scanning and comprehension.

Compelling Calls-to-Action (CTAs)

Strong CTAs guide visitors clearly to the next step. Instead of generic phrases, use explicit, action-oriented language like "Schedule Your Private Investment Consultation" or "Access Your Exclusive Market Forecast."

The placement, colour, and size of your CTA buttons also matter significantly. Make them stand out visually from the rest of the page, position them prominently above the fold, and ensure they're large enough to be easily clickable on mobile devices.

Consider adding a sense of exclusivity to your CTAs to appeal to high-net-worth individuals who value personalised attention.

Trust-Building Elements

Sophisticated investors need reassurance before committing. Incorporate elements like testimonials from similar clients, recognisable industry awards, compliance certifications, or endorsements from respected financial institutions to build immediate trust.

Including logos of respected financial institutions, regulatory bodies, or prestigious client types (without naming specific clients if confidentiality is required) can significantly enhance credibility.

Security badges and compliance statements addressing privacy concerns are particularly important when targeting high-net-worth individuals who prioritise discretion and data security.

Engaging Visuals

Visuals are aesthetically pleasing and can be very persuasive. Incorporate charts, graphs, short explanatory videos, or infographics to simplify complex investment ideas and enhance engagement.

Visual elements should support and enhance your message, not distract from it.

For targeting institutional investors, clean, professional graphics that illustrate concepts like portfolio diversification, risk-adjusted returns, or long-term growth can help visitors quickly grasp your value proposition without requiring extensive reading.

Fast and Mobile-Friendly

High-net-worth individuals and institutional decision-makers often browse on-the-go. Make sure your PPC landing pages load quickly and look perfect on any device—especially mobile. Slow-loading or cumbersome mobile pages can quickly lose potential clients.

Effective Design for Discerning Financial Audiences

Your PPC landing pages should communicate credibility and professionalism from the outset.

In the financial sector, where trust and clarity are essential, a clean, minimal design approach is far more effective than cluttered or overly stylised layouts.

Prioritise a structured layout that guides the eye intuitively, making key information and calls to action visible immediately—ideally without the need to scroll..

Typography should be elegant yet highly legible, and generous spacing between elements allows content to breathe. Also consider using a muted, confident colour palette—deep blues, subtle golds and neutral tones all help to project reliability and exclusivity.

Staying Compliant and Trustworthy

Regulatory compliance is critical in financial marketing. Clearly present necessary disclosures, terms, and risk warnings on your PPC landing page. Transparency is vital in meeting regulations and earning client trust.

Working with compliance professionals will ensure your landing pages meet all regulatory requirements while maintaining their marketing effectiveness.

Consider using expandable sections for detailed disclosures so visitors can access necessary information without cluttering the main content area.

Making it Personal

Personalising content based on investor demographics, portfolio size, investment preferences, or browsing history can help visitors feel more recognised and valued.

As a result, this tailored approach can significantly boosts conversions by making content relevant and engaging. Dynamic content that changes based on the visitor's source, investor type, or previous interactions can also dramatically improve relevance.

Segmenting your financial firm's audience by investor profile, portfolio size, or specific investment interests will help you to present the most appropriate messaging and offers to the right prospects.

Reducing Friction in the Conversion Process

Every additional step or field in your conversion process creates friction that can lead to abandonment. Streamline the forms on your landing pages to collect only essential information at the initial stage, leaving more detailed data gathering for later in the relationship.

CRM and Marketing Automation Integration

Connecting your PPC landing pages to a CRM system simplifies lead management. You can automate follow-up processes, so potential clients are nurtured consistently through to conversion.

Automated nurturing sequences can also deliver targeted content based on the specific investment interests the prospect showed, keeping your firm top-of-mind throughout the decision-making process.

Continuous Improvement through A/B Testing

Consistently test your PPC landing pages—vary headlines, images, copy, and CTAs—to discover precisely what resonates best with your investor audience. Regular, small adjustments based on real-world data will keep your PPC strategy effective.

Establish a systematic testing schedule, focusing on one element at a time to clearly identify what influences conversions.

In institutional and high-net-worth client investing, decision cycles tend to take longer, so be patient with your testing and collect sufficient data before drawing any conclusions. The insights gained can significantly improve ROI over time so it's worth doing properly.

PPC Landing Pages and SEO

While pay-per-click landing pages primarily target paid visitors, optimising them with relevant financial keywords can help improve Google's Quality Score. Better scores translate to lower CPCs and higher ROI.

Though PPC landing pages typically have limited navigation and fewer internal links than standard website pages, they should still follow SEO best practices.

Use descriptive, keyword-rich page titles, sub-headings, image alt text, metadata, and schema while incorporating relevant investment terminology naturally within the content.

Advanced Remarketing Strategies for Financial Services

Visitors who don't convert initially remain valuable prospects. Implement sophisticated remarketing strategies that deliver increasingly targeted messages based on the specific investment services they viewed on your landing page.

Create remarketing segments based on the specific investment products or services viewed, the level of engagement (time on page, number of pages viewed), and where they abandoned the conversion process.

This will allow for highly relevant follow-up messaging that addresses specific objections or information gaps.

Tracking Your Progress with Analytics

Regularly monitor key metrics including:

- Conversion rates

- Bounce rates

- Average time on page

- Cost-per-acquisition (CPA)

Use these insights to refine your strategy and continually improve performance.

Go beyond basic metrics to understand the quality of leads generated. Track conversions and downstream metrics like qualified leads, consultations scheduled, and assets under management gained.

For more information check out our PPC conversion tracking guide

Capturing Leads Strategically

Visitors not ready to convert immediately can still become valuable leads. Offer premium content—like exclusive market analyses or investment whitepapers—in exchange for their contact details.

Use gated content that addresses specific challenges in wealth preservation, alternative investments, or tax-efficient strategies to attract qualified prospects.

Final Thoughts

In short, there are a lot of elements that go into creating a successful PPC landing page—but ultimately, it all comes down to delivering a seamless, reassuring experience for the end user.

For financial clients, that means removing friction, building credibility, and presenting information in a way that feels both personalised and professional.

Regular testing, refinement and optimisation are essential for keeping performance on track and adapting to changes in client behaviour or market conditions-your landing page should evolve alongside your goals and audience expectations.

Shane McEvoy is a financial marketing expert with over 30 years' experience in digital advertising and financial services. He founded Flycast Media, a leading financial marketing agency, and has authored several influential guides and regularly contributes to respected industry publications - read his profile.