20 STOCK MARKET SAYINGS

YOU NEED TO KNOW

Essential Quotes For Savvy Investors

Navigating the stock market can be a very complex subject so it doesn't hurt to garner a little wisdom from those renowned investors and legendary financiers you may have heard of. In many instances these quotes are worth their weight in gold.

These timeless stock market sayings provide a wealth of knowledge into market behaviour, investment strategies, risk management, understanding market psychology, recognising the importance of patience and so much more.

They encapsulate the core principles of successful investing and will help you make more informed decisions and enhance your financial acumen.

Famous stock market sayings by:

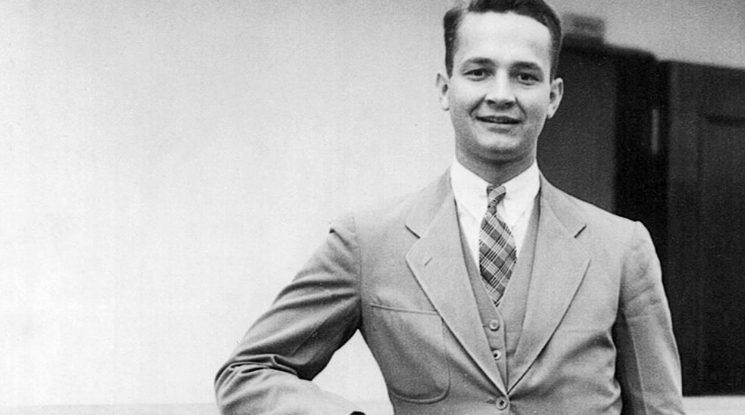

Jesse Livermore

Jesse Livermore was an American stock trader known for his successful short selling during the 1929 stock market crash. His trading strategies and insights have influenced generations of investors. Despite his financial ups and downs, his legacy endures through his timeless market wisdom.

Jesse Livermore quote: "The market does not beat them. They beat themselves, because though they have brains they cannot sit tight."

Rudy Havenstein

Rudy Havenstein is a senior market commentator who runs a parody social media account of Rudy Havenstein highlighting the cautionary tale of monetary policy and the perils of inflation. Rudy Havenstein was the President of the Reichsbank in Germany during the Weimar Republic, infamous for his role in the hyperinflation crisis of the early 1920s. His policies led to the extreme devaluation of the German mark.

Rudy Havenstein Quote: "Inflation is when you pay fifteen dollars for the ten-dollar haircut you used to get for five dollars, when you had hair."

Stanley Druckenmiller

Stanley Druckenmiller is a renowned American investor and hedge fund manager, best known for his work with George Soros at the Quantum Fund. He famously helped Soros "break the Bank of England" in 1992, earning massive profits. Druckenmiller's focus on macroeconomic trends has made him a legend in the investment community.

Stanley Druckenmiller Quote: "Earnings don't move the overall market; it's the Federal Reserve Board. Focus on the central banks, and focus on the movement of liquidity."

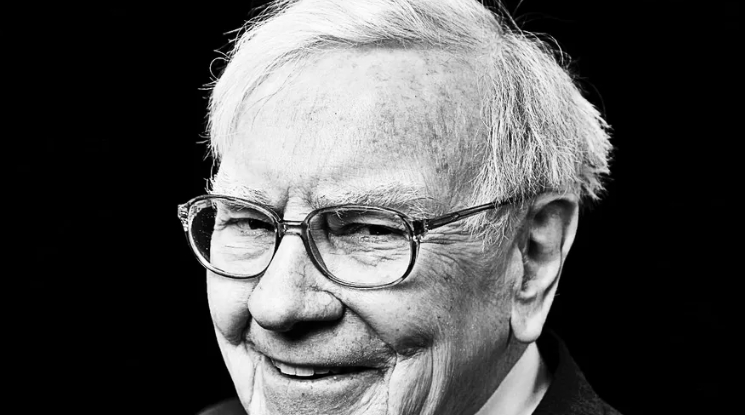

Warren Buffett

Warren Buffett, known as the "Oracle of Omaha," is one of the most successful investors of all time. As the chairman and CEO of Berkshire Hathaway, his investment philosophy focuses on value investing and long-term growth. Buffett's wisdom and annual letters to shareholders are highly regarded in the financial world.

Warren Buffett Quote: "Be fearful when others are greedy and greedy when others are fearful." "It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price."

Jeremy Grantham

Jeremy Grantham is a British investor and co-founder of GMO, an asset management firm. He is known for predicting major financial bubbles, including the dot-com bubble and the 2008 financial crisis. Grantham's investment philosophy often emphasizes environmental sustainability and long-term market trends.

Jeremy Grantham Quote: "Every bubble ends with the same words: 'This time is different."

The Raven of Zürich (Fritz Leutwiler)

Fritz Leutwiler, known as the "Raven of Zürich," was a prominent Swiss banker and the head of the Swiss National Bank. He played a key role in stabilizing the Swiss economy during turbulent times. Leutwiler was known for his cautious and strategic approach to monetary policy.

Fritz Leutwiler Quote: "A prudent investor should always keep some dry powder in reserve."

Peter Lynch

Peter Lynch is a legendary American investor best known for managing the Magellan Fund at Fidelity Investments. Under his management, the fund achieved an annual return of 29% from 1977 to 1990. Lynch is famous for his "invest in what you know" philosophy and has authored several books on investing.

Peter Lynch Quotes: "Know what you own, and know why you own it."

"Far more money has been lost by investors trying to anticipate corrections than lost in the corrections themselves."

John Templeton

John Templeton was a pioneering global investor and mutual fund manager. He founded the Templeton Growth Fund and was known for his contrarian investment style, seeking value in overlooked markets. Templeton's philanthropic efforts and investment wisdom have left a lasting impact on the financial world.

John Templeton Quote: "The four most dangerous words in investing are: 'This time it's different.'"

Benjamin Graham

Benjamin Graham, often called the "father of value investing," was a profound economist and professional investor. His books, "Security Analysis" and "The Intelligent Investor," laid the groundwork for value investing principles. Graham's teachings have influenced countless investors, including Warren Buffett.

Benjamin Graham Quote: : "In the short run, the market is a voting machine, but in the long run, it is a weighing machine."

Paul Tudor Jones

Paul Tudor Jones is an American billionaire hedge fund manager, known for founding Tudor Investment Corporation. He gained fame for predicting the 1987 stock market crash and profiting from it. Jones emphasizes the importance of risk management and playing great defence in trading.

Paul Tudor Jones Quote:: "The most important rule of trading is to play great defence, not great offence."

Ray Dalio

Ray Dalio is the founder of Bridgewater Associates, one of the world's largest hedge funds. Known for his principles-based approach to investing and management, Dalio has written extensively on economic cycles and financial markets. His book, "Principles," shares his philosophy on life and business.

Ray Dalio Quote: "He who lives by the crystal ball will eat shattered glass."

George Soros

George Soros is a Hungarian-American investor, philanthropist, and author, best known for "breaking the Bank of England" by shorting the British pound in 1992. His Quantum Fund achieved extraordinary returns under his leadership. Soros is also known for his extensive philanthropic efforts through the Open Society Foundations.

George Soros Quote: "It's not whether you're right or wrong that's important, but how much money you make when you're right and how much you lose when you're wrong."

Carl Icahn

Carl Icahn is an American investor and corporate raider known for his aggressive activist investing style. He has made significant profits by taking substantial stakes in companies and pushing for changes to increase shareholder value. Icahn's strategies have made him a prominent figure on Wall Street.

Carl Icahn Quote: "In takeovers, the metaphor is war. The secret is reserves. You must have reserves stretched way out ahead."

David Tepper

David Tepper is an American billionaire hedge fund manager and founder of Appaloosa Management. Known for his bold investment decisions during market downturns, Tepper has achieved remarkable success. He is also a major philanthropist and owner of the Carolina Panthers NFL team.

David Tepper Quote: "I am the animal at the head of the pack. I either get eaten, or I get the good grass."

Jim Rogers

Jim Rogers is an American investor and co-founder of the Quantum Fund with George Soros. Known for his extensive knowledge of global markets, Rogers has authored several books and is a frequent commentator on economic issues. He is also famous for his adventurous travels to gather insights into global economies.

Jim Rogers Quote: "Buy when there's blood in the streets, even if the blood is your own."

John Paulson

John Paulson is an American hedge fund manager who became famous for his bet against the U.S. housing market in 2007, earning billions. Founder of Paulson & Co., he is known for his strategic investment acumen. Paulson's success story is a highlight of financial market history.

John Paulson Quote: "You don't get rewarded for taking risks, you get rewarded for buying cheap assets."

Michael Burry

Michael Burry is an American investor and founder of Scion Capital. He gained fame for his role in predicting and profiting from the subprime mortgage crisis, as chronicled in "The Big Short." Burry's investment strategies often focus on deep value and contrarian principles.

Michael Burry Quote: "The most important question to ask before buying a stock is why it's mispriced."

Charlie Munger

Charlie Munger is the vice chairman of Berkshire Hathaway and Warren Buffett's longtime business partner. Known for his sharp intellect and wit, Munger has played a crucial role in shaping Berkshire's investment strategy. His multidisciplinary approach and emphasis on rational thinking have made him a respected figure in finance.

Charlie Munger Quote: "The big money is not in the buying and the selling, but in the waiting."

Seth Klarman

Seth Klarman is a highly regarded value investor and the founder of Baupost Group, one of the largest hedge funds in the world. Known for his cautious investment style and focus on risk management, Klarman is also the author of "Margin of Safety," a seminal book on value investing. His insights are widely followed by investors.

Seth Klarman Quote: "Most investors are primarily oriented toward return, how much they can make, and pay little attention to risk, how much they can lose."

For more pearls of wisdom on navigating today's financial markets, check out the secrets of smart investing with Russell Napier's 21 timeless investing principles.

Grow Your Fund with Marketing Tailored to Investors

To attract high-value clients, you need a digital strategy designed for the financial world. We help

hedge funds, discretionary investment firms, and fintech companies reach serious investors

with precision-targeted campaigns. Don’t just participate in the market—

lead it with our specialised marketing.

Shane McEvoy is a financial marketing expert with over 30 years' experience in digital advertising and financial services. He founded Flycast Media, a leading financial marketing agency, and has authored several influential guides and regularly contributes to respected industry publications - read his profile.