A PRACTICAL GUIDE TO CONDUCTING A

FINANCIAL SERVICES SOCIAL MEDIA AUDIT

TL;DR: 📈

- A financial services social media audit: helps to identify gaps, boosts performance, and aligns your social media channels with your firms main goals.

- Evaluating everything, from branding consistency and engagement metrics to platform strategy and competitor performance.

- Get expert support to translate your audit into an ROI-driven social media plan tailored to your firm’s objectives.

Drive Engagement And Improve ROI On Social Media

If you're a company in the financial services industry, you understand the importance of having a strong social media presence. However, are you truly maximising the full potential of your social media marketing?

A social media audit is one of the best ways you can improve your financial services social media results. It doesn't need to take long, but it's crucial to get a few things right.

With an estimated 5.22 Billion users as of October 2024, it's worth taking the time to evaluate your financial services social media strategy. An audit may sound daunting, but it's simply a matter of having a checklist and measuring results against specific benchmarks.

Let's explore how you can determine if your financial social media plan is poised for success or headed for disappointment in the coming months.

Conducting a Financial Services Social Media Audit

If this is your first time conducting a social media audit, don’t worry—it’s a straightforward process that involves identifying strengths, weaknesses, and opportunities across your channels. The following is a step-by-step approach you can use to improve your social media.

Here’s what you need to do.

1. Define Your Social Media Goals and KPIs

Before analysing your data, it’s essential to have a clear understanding of what your social media strategy is intended to accomplish. For financial services companies it’s about generating followers and aligning your efforts with measurable business objectives that contribute to growth, client acquisition, and brand credibility.

A well-defined set of goals and Key Performance Indicators (KPIs) will keep your social media strategy focused and help you measure success effectively:

- Building Credibility: Position your firm as an authority in investment management, market analysis, or fintech innovation.

- Increasing Client Acquisition: Generate leads from high-net-worth individuals, institutional investors, or fintech early adopters.

- Driving Engagement: Increase likes, shares, and comments to enhance visibility and audience trust.

- Educating Your Audience: Simplify complex financial topics, such as ESG investing, retirement planning, or blockchain technology, to attract engagement.

Key Metrics to Monitor:

- Follower growth across platforms.

- Engagement rates (e.g., likes, shares, comments).

- Website referral traffic and click-through rates.

- Conversion rates, such as consultations booked or funds invested.

Pro Tip: Tie each KPI directly to business objectives, such as increasing AUM or boosting attendance for investment seminars.

2. Maintain a Detailed Record of Your Audit Results

A social media audit isn’t just a one-time activity; it’s an ongoing process that requires regular tracking and analysis to be effective. Without a detailed and organised record of your findings, it’s nearly impossible to measure progress, identify trends, or make data-driven adjustments.

This is especially critical in the financial services industry, where long-term consistency, credibility, and compliance play a significant role.

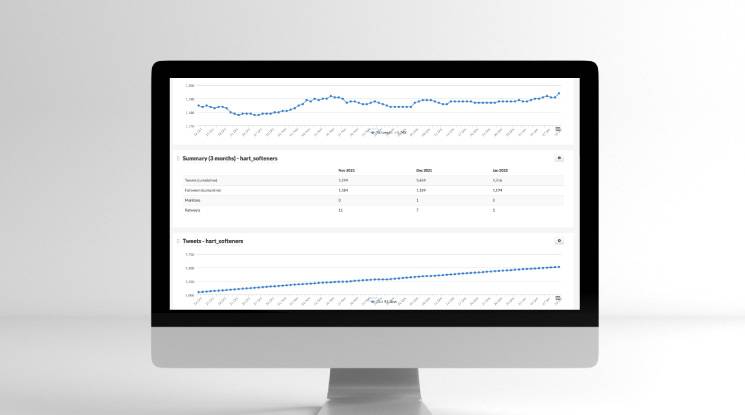

For example, tracking audience engagement on LinkedIn over six months could reveal patterns that help you better connect with institutional investors, or analysing performance metrics on Twitter might show how timely economic commentary drives audience growth.

Pro Tip: Choose a format, such as a spreadsheet or analytics dashboard, that is easy to update and visually represents performance trends for stakeholders.

Metrics to Include:

- Dates of audits and intervals (monthly or quarterly).

- Active Social media platforms (LinkedIn, Twitter, YouTube, Instagram, TikTok, etc.).

- Social Media Profile URLs

- Follower counts and percentage changes since the last audit

- Engagement statistics and percentage changes (e.g., average likes, shares, comments)

- Demographic insights, such as audience location, age, and interests.

- Top-performing posts, including content type and timing.

- Referral traffic data (plus any notable changes)

- Any network specific metrics (for example from your YouTube audit)

- Compliance adherence and flagged issues.

- The media, style, hashtags and posting times of your most popular posts

When you're analysing your data, just bare in mind other factors that could impact your financial services social media performance. For example, you should also consider the impact of external events such as market fluctuations, new regulations or economic events. Also, if you have different products or services, you should also evaluate their performance separately and see if there are any notable differences.

3. Audit All Of Your Social Media Channels

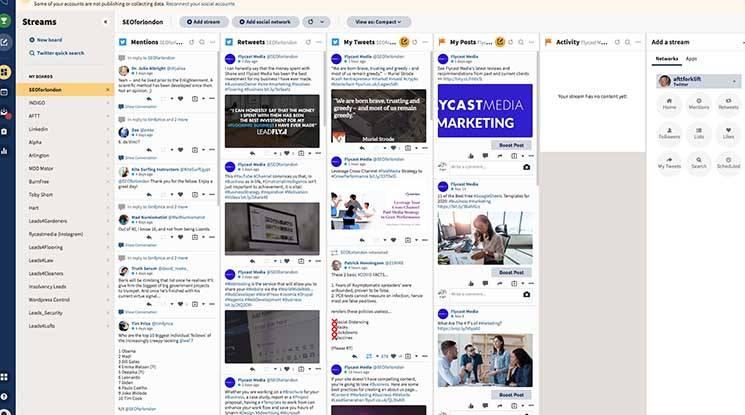

We’ve emphasised the ALL here because it’s easy to think of a social media audit being undertaken just for Facebook or Twitter. However, you need to make sure you’re auditing all of your channels.

If you opened your social media accounts a while back. you might be surprised by how many you have.

The list may include forgotten about experimental channels you set up in the early days, or additional ones that have been created by employees since. It’s easy to pick out the better-known channels like Twitter or LinkedIn, or more contemporary short video specialists like TikTok, just don't forget the others.

What to Do:

- Compile a list of all platforms where your brand is present.

- Include niche or lesser-used platforms targeting specific audiences.

- Record both active and dormant profiles noting down relevant stats for evaluation.

- Identify duplicate or unclaimed accounts that could confuse clients.

Pro Tip: Focus on platforms where your target audience is most active. LinkedIn is invaluable for B2B networking, while Twitter suits hedge funds sharing timely market insights.

4. Check For Branding And Detail Inconsistencies

For asset managers, hedge funds, investment firms, and fintech companies, a consistent brand across all social media platforms is essential for building trust and establishing authority.

Inconsistencies in your branding, such as mismatched visuals, outdated bios, or incorrect links, can confuse potential clients and damage your firm’s reputation.

Your branding should communicate your firm’s values and unique offerings clearly, whether you’re targeting institutional investors, high-net-worth individuals, or fintech partners.

Why Branding Consistency Matters:

- Reinforces your firm’s reputation as a trustworthy and professional entity.

- Makes it easier for clients and investors to recognise and remember your brand.

- Enhances user experience by providing clear, seamless interactions across platforms.

- Presents a unified, professional image that aligns with your business goals.

Key Areas to Review:

1. Logos and Visuals:

- Ensure the same logo, colour scheme, and design elements are used across all platforms.

- Use high-resolution images to maintain a polished, professional appearance.

2. Messaging:

- Align bios, descriptions, and tone with your firm’s core values, expertise, and goals.

- Highlight your unique selling points (e.g., “20+ years of discretionary investment expertise” or “Innovative fintech solutions for modern investors”).

3. Links:

- Verify that all URLs are active and lead to optimised landing pages tailored to each platform’s audience. For instance, a Twitter link could direct users to a fund performance report, while a LinkedIn link might lead to a consultation booking page.

- Avoid broken or outdated links, which can damage trust and user experience.

4. Banner Images:

- Tailor visuals to showcase your firm’s services or milestones, such as wealth management strategies, ESG investment offerings, or award recognitions.

- Use dynamic banners to promote current campaigns, like an upcoming webinar or a newly launched fund.

5. Contact Information:

- Ensure phone numbers, email addresses, and office locations are accurate and up to date.

- Include consistent contact options across platforms, such as a direct message link or a form for client inquiries.

6. Call-to-Action (CTA):

- Align CTAs with platform-specific objectives. For example, use “Schedule a Consultation” on LinkedIn and “Learn More About Our Fintech Solutions” on Instagram.

- Ensure that CTAs are clear, actionable, and consistent across platforms.

7. Compliance Messaging:

- Include disclaimers or regulatory statements where required. For instance, add disclaimers about investment risks or regulatory compliance to bios and posts.

- Ensure all compliance-related information is consistent across profiles to avoid confusion or regulatory breaches.

8. Profile Photos:

- Use the same professional headshot or logo as your profile picture across platforms to ensure instant recognition.

- For fintech companies, consider using creative but professional images that reflect innovation while maintaining credibility.

9. Alignment with Target Audience Expectations:

- Consider the tone and style of messaging that resonates with your specific audience. For example, institutional investors might expect a formal, data-driven tone, while fintech audiences may prefer a more approachable and innovative style.

5. Locate And Analyse Your Most Successful Social Media Posts

To refine your social media strategy, it’s essential to identify what works well and what doesn’t. Analysing successful and underperforming posts provides valuable insights into audience preferences which can help you better connect with potential clients, investors, and industry peers.

Rather than focusing solely on vanity metrics like likes or shares, look into the specific factors driving engagement. Consider how different types of content, messaging styles, and post timing have influenced past performance to enhance future content.

Key Metrics to Analyse:

Media Type:

Determine which types of content resonate most with your audience. Videos, infographics, and carousel posts often perform well for financial education and market insights. For instance, a video explaining ESG investing might drive higher engagement than a simple text post.

Post Language and Syntax:

Review the tone, structure, and style of your posts. Does your audience respond better to formal, data-driven language or conversational messaging? Assess whether posts that include calls to action, such as “Download our latest market report,” or questions, like “What’s your top investment priority for 2024?”, generate more responses.

Hashtags:

Evaluate the impact of hashtags used in your posts. Determine whether broad terms like #Finance or more specific ones like #HedgeFunds or #WealthManagement drive better visibility and engagement. Test a combination of branded and trending hashtags to maximise reach.

Engagement Trends:

Assess metrics like likes, shares, comments, and click-through rates to understand what drives interaction. For example, posts that spark meaningful discussions in the comments section or generate shares can indicate strong audience interest and trust in your content.

Timing and Frequency:

Analyse when your audience is most active and how post frequency impacts engagement. Do posts shared during business hours outperform those published in the evening? Understanding timing helps you optimise your posting schedule.

Post Topics and Themes:

Identify recurring topics or themes in your best-performing posts. Do posts about investment strategies, regulatory updates, or emerging trends like cryptocurrency or ESG resonate most? Analyse whether your audience prefers timely updates, such as market commentary, or evergreen content, such as investment planning guides.

Audience Interaction:

Review how your audience engages with your posts beyond basic metrics. Are they asking questions, sharing insights, or reacting positively to your content? Evaluate your responses to comments—prompt, thoughtful replies can encourage further interaction and build trust.

Platform-Specific Performance:

Analyse how content performs on different platforms. For example, LinkedIn might favour thought leadership posts and professional insights, while Instagram or TikTok might be better suited for visually engaging content like infographics or short videos. Tailor your content to each platform’s audience and strengths.

CTA Effectiveness:

Assess the success of calls-to-action within your posts. For instance, do posts encouraging users to “Sign up for our webinar” or “Download our guide to market trends” lead to conversions? Strong, actionable CTAs are critical in driving tangible results.

Content Longevity:

Determine how long your content remains relevant. For example, evergreen posts about investment principles might continue to generate engagement over time, while time-sensitive content like market commentary may see a quicker drop-off in performance.

6. Conduct a Competitor Analysis

Aside from analysing your own content and metrics, your competitors' social media strategies can also provide valuable insights to help you refine your own approach.

You can use your competitor analysis to learn from their successes and failures and identify opportunities you may otherwise have missed. This process is especially useful for identifying gaps in their strategies that your firm can exploit to gain a competitive edge.

What to Analyse:

1. Their Most Popular Content and Why It Resonates:

- Review posts that achieve high engagement. Are they using videos to explain market trends, publishing infographics on performance metrics, or sharing client success stories?

- Consider how these topics align with your target audience’s interests. For example, if ESG investing posts perform well for a competitor, it might signal growing client demand for sustainable investment options.

- Look for recurring themes or topics that appear to generate consistent interest, such as market forecasts or regulatory updates.

2. Engagement Rates and Audience Interaction Levels:

- Compare likes, shares, and comments across platforms to understand which types of content encourage audience participation.

- Evaluate the tone and quality of interactions. For example, do their posts spark meaningful discussions, or are they limited to superficial engagements like likes?

- Assess whether they respond promptly to comments and how effectively they address audience questions or concerns.

3. Innovations and Content Formats:

- Identify whether competitors are using cutting-edge techniques to attract attention, such as live streaming market analysis, creating interactive polls, or experimenting with augmented reality tools for financial education.

- Assess their use of video formats, such as Instagram Reels, YouTube explainers, or LinkedIn Live events. For fintech firms, this could include demonstrations of product features or behind-the-scenes development stories.

4. Thought Leadership Efforts:

- Review their contributions to industry discussions, such as LinkedIn articles, whitepapers, or participation in online panels.

- Evaluate whether their content positions them as leaders in areas like portfolio management, fintech innovation, or market insights.

- Analyse the depth and relevance of their thought leadership, ensuring your strategy offers a unique perspective or deeper value.

5. Brand Voice and Positioning:

- Consider how competitors frame their messaging. Is their tone formal and authoritative, or approachable and client-friendly?

- Assess how they highlight their unique selling points, such as a focus on transparency, technology, or bespoke services.

6. Platform Strategy:

- Examine which platforms competitors prioritise and how they use each one. For instance, do they focus on LinkedIn for thought leadership and networking, while using Instagram for visual storytelling?

- Look for gaps—are they neglecting platforms that could engage a younger, tech-savvy audience, such as TikTok or Twitter?

7. Evaluate Platform-Specific Performance and Audience Alignment

Not all social media platforms serve the same purpose or cater to the same audience, especially in the financial services industry.

To ensure your strategy is effective, it’s crucial to evaluate the performance of each platform individually and assess whether your content aligns with the audience expectations specific to that channel.

This step helps you allocate resources more efficiently, focusing on platforms that deliver the highest ROI while refining your messaging for maximum impact.

Analyse Platform Metrics

Each platform offers unique analytics tools that can provide insights into performance. For example, LinkedIn Analytics highlights follower growth and engagement with professional audiences, while Twitter Insights can reveal trends in impressions and retweets for real-time updates.

Use these tools to evaluate metrics like clicks, engagement rates, and audience growth. This analysis will help you determine whether a platform is meeting your business objectives, such as driving traffic to your website or generating leads.

Match Content to Platform Strengths

Different platforms excel at different types of content, and your strategy should reflect this. For example, LinkedIn is best for thought leadership articles and professional networking, making it ideal for investment houses or hedge funds targeting institutional clients.

Twitter can amplify time-sensitive market updates or news, while Instagram and TikTok may work better for fintech firms seeking to connect with younger, tech-savvy audiences through visually engaging posts or quick explainer videos. YouTube is a great platform for in-depth content like educational videos or tutorials on financial planning.

Understand Audience Demographics

Review each platform’s audience demographics to confirm they align with your target personas. LinkedIn is likely to attract institutional investors, financial professionals, and corporate executives, whereas platforms like Instagram or TikTok might reach a younger demographic more interested in fintech innovations or beginner financial advice.

Use this data to refine your messaging and focus your efforts on platforms where your audience is most active.

Review Engagement Trends

Evaluate how your audience interacts with your content on each platform. Do posts on LinkedIn generate meaningful discussions in the comments, or do Instagram Stories drive website traffic?

Understanding these trends allows you to prioritise channels that foster the most valuable engagement, whether that’s lead generation, brand awareness, or audience trust.

Test New Features

Social media platforms frequently introduce new tools and features that can enhance your content’s visibility and engagement.

For example, Instagram Reels and LinkedIn Live are excellent for creating dynamic, engaging content. Experimenting with these features may reveal untapped opportunities to better connect with your audience.

Expert Social Media Management Services

Completing a social media audit is just the beginning. Analysing the results and implementing changes is where the real transformation happens. Whether your goal is to amplify your successes, address underperformance, or redefine your strategy, now is the time to take your social media presence to the next level.

You could handle these changes on your own, but why not work smarter? By partnering with experts, you gain access to proven strategies, tailored solutions, and the latest tools to achieve measurable results faster.

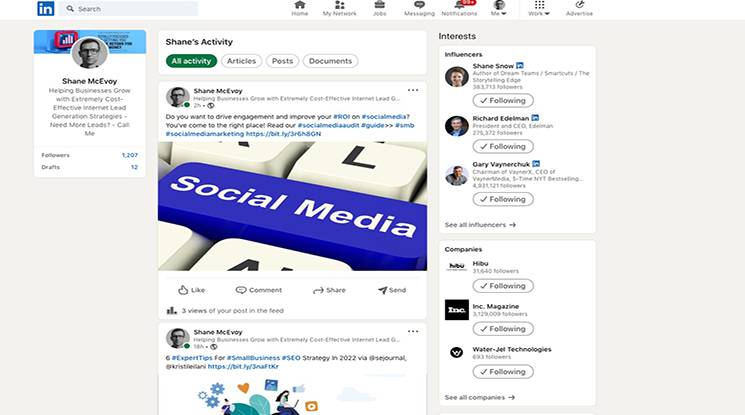

Shane McEvoy is a financial marketing expert with over 30 years' experience in digital advertising and financial services. He founded Flycast Media, a leading financial marketing agency, and has authored several influential guides and regularly contributes to respected industry publications - read his profile.